Best Credit Cards In India – 3 Types Credit Cards Available in Different Banks

- Rupay Credit Cards – UPI Payments

- Life Time Free Credit Cards (No- Joining Fee & No – Yearly Fee)

- Credit Cards with Joining Fee & Yearly Fee Applicable

RUPAY CREDIT CARDS

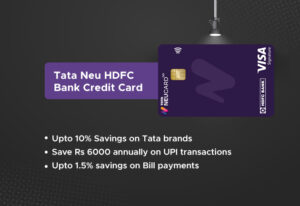

HDFC Bank Tata Neu Credit Card

HDFC Bank Tata Neu Credit Card Apply Now Click Here

- You get 7% money back as tata neu coins (2% due to the card + 5% on TataNeu app) for all Tata brands like BigBasket, Air Asia, Tata 1mg, Croma, TataCliQ, Westside, Titan, Tanishq, etc. Applicable for transactions done on TataNeu app/website and registering for Tata NeuPass

- Upto 1.5% savings on all UPI spends via Tata Neu App using NeuCard (maximum of Rs 500 per month)

- Get 12 free airport lounge access (8 domestic + 4 International) per annum on NeuCard Infinity

- 4 Domestic lounge access on NeuCard Plus

Other Amazing Offers –

- 1% fuel surcharge waiver at all fuel stations across India on transaction of Rs 400 – Rs 5,000. (Max. waiver of Rs 250 / 500 per statement cycle for Plus/Infinity

- Leverage revolving credit facilities at nominal interest rates

- Get zero lost card liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

Fees & List of all charges

- Joining Fees: Free for limited time only

- Annual Fees: NeuCard Infinity – Rs 1499 + Taxes

- Annual Fees: NeuCard Plus – Rs 499 + Taxes

Documents Needed

- Address Proof – Aadhaar, Passport, Latest utility bills

- ID proof – PAN, Voter ID, Passport

- Income proof – Bank Statement, Salary Slips

Eligibility Criteria

- Required Age: 21-65 years

- Employment status: Salaried or Self-Employed

- Minimum Income: Rs 25,000 per month (Salaried)

- Minimum Income: Rs 6 lakhs per annum (Self-Employed)

How to Avail the Offer

- You will be redirected to Tata Digital page

- Click Login/Join Now and do OTP verification

- You will see the cards you are eligible for, select the card and provide the required details

- Complete your VKYC within 72 hours of your application

Axis Indian Oil Rupay Credit Card

Apply Now Click Here

100% Cashback upto Rs 250 on all fuel spends within first 30 days of card issuance

10% instant discount on movie tickets booked via BookMyShow website

Enjoy upto 15% Discount on partner Restaurants

ELIGIBILITY CRITERIA – CREDIT CARD

Employment status: Salaried or Self-Employed

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-65 years

Available across major cities in India

FEES AND LIST OF CHARGES

Joining Fees: Rs 500 (excluding GST)

Annual Fees: Rs 500 (excluding GST)

Annual fees waiver: Rs 50,000 spends in one calendar year

Interest rate: 3.6% per month

Cash Withdrawal charges: 2.5% (Min Rs 500)

LIFE TIME FREE CREDIT CARDS

ICICI Bank Credit Card

Apply Now Click Here

Lifetime FREE – Select Variants of ICICI Bank Credit Card are offered without any joining or Annual Fee

Discount on Online Sales – With ICICI Credit Card, you can avail great discount offers on Amazon/Flipkart Sales

Earn 2 Reward Points on every Rs 100 spent for all retail purchases except fuel

Get 1 Reward Point on every Rs 100 spent on utilities and insurance categories

You can use ICICI Bank Credit Card to avail discounts over many websites like MakeMyTrip, Sterling Resorts, Haier, McDonalds etc.

You earn rewards on all spends that can be redeemed for exciting gifts, vouchers or free flight tickets

ELIGIBILITY CRITERIA- CREDIT CARD

Age group: 21-65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 50,000 per month (Both Salaried and Self-Employed)

Credit score: 750+

You should be citizen of India or a Non-Resident Indian

DOCUMENTS NEEDED

PAN Card

Aadhaar Card

Bank Statement

FEES AND LIST OF ALL CHARGES

Joining Fees: Lifetime Free (Depending upon the card selected)

Annual Fees: Lifetime Free (Depending upon the card selected)

Axis Neo Credit Card

Apply Now Click Here

Get 40% Off on Zomato – 2 times a month

10% Off on Myntra everytime

5% Off on Utility Bill payments via Amazon pay.- once per month

10% Off on Blinkit (Max Discount Rs 250)

10% Off on BookMyShow (Max discount – Rs 100) – valid once a month

OTHER AMAZING OFFERS

Get 1 Edge reward point on every Rs 200 spent ( 1 RP = Rs 0.20)

Upto 15% Off at partner restaurants under Dinning Delights program via EazyDiner

Get zero lost card liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

FEES & LIST OF CHARGES

Lifetime FREE Credit Card

Joining Fees: NA

Annual fees: NA

DOCUMENTS NEEDED- CREDIT CARD

PAN Card/Form 60

Colour photograph

Address Proof

ID Proof

Bank statement or Income Proof

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 21,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-60 years

AU Altura Credit Card – Earn reward points every time you spend

Apply Now Click Here

Fuel waiver, railway lounge benefits & more with Lifetime FREE AU Altura Credit Card

Get 5% Cashback on minimum Rs 2,500 retail spends done within first 60 days of card setup

You Earn Flat Rs 1540 Profit on Successful Card Disbursal

FEATURES OF THE CARD

2% Cashback on all retail spends done at Grocery stores, Departmental stores and Utility bill payments (Maximum cashback per statement cycle is Rs 50)

1% Cashback on all other retail spends (Maximum cashback per statement cycle is Rs 50)

Get additional cashback of Rs 50 on completing a minimum of Rs 10,000 retail spends in every statement cycle

2 complimentary lounge access per calendar quarter, using VISA Card at railway stations in New Delhi, Kolkata (Sealdah), Jaipur, Ahmedabad and Agra

1% Fuel Surcharge Waiver for fuel transactions done between Rs 400 and Rs 5,000 across all fuel stations in the country

Convert your transactions worth INR 2,000 or more into easy EMI options on selected tenure of your choice

PARTNER DISCOUNTS

10% Instant Discount (Upto Rs 1,000) on Flipkart Orders Above Rs 10,000

Additional 10% Off (Upto Rs 1000) on a minimum purchase of Rs 3999 on selected styles on Myntra

15% instant discount (Upto Rs 300 per month) on Tata CLiQ Orders Above Rs 500

10% off on Groceries (Upto Rs 100) on Blinkit app orders above Rs 499

10% off on Swiggy Instamart (Upto Rs 100 per month) on Orders Above Rs 500

FEES & LIST OF ALL CHARGES

Lifetime FREE Credit Card

Joining Fees: Nil

Annual Fees: Nil

ELIGIBILITY CRITERIA- CREDIT CARD

Required Age: 21-60 years

Employment status: Salaried or Self-Employed

Income: Rs 25,000 per month (Salaried and Self-employed)

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

DOCUMENTS NEEDED

Valid PAN Card

Aadhar Card – should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

AU Altura Plus Credit Card

Apply Now Click Here

1.5% Cashback on all POS retail spends done (Except Fuel) at merchant outlets (Maximum cashback per statement cycle is Rs 100) 2X Reward Points (i.e., 2 Reward Points per Rs 100 retail spends) for all your online transactions

2 complimentary lounge access per calendar quarter, using VISA Card at railway stations in these cities New Delhi, Kolkata (Sealdah), Jaipur, Ahmedabad and Agra

1% Fuel Surcharge Waiver for fuel transactions done between Rs 400 and Rs 5,000 across all fuel stations in the country

Convert your transactions worth INR 2,000 or more into easy EMI options on selected tenure of your choice

PARTNER DISCOUNTS

10% Instant Discount (Upto Rs 1,000) on Flipkart Orders Above Rs 10,000

Additional 10% Off (Upto Rs 1000) on Myntra

15% instant discount (Upto Rs 300 per month) on Tata CLiQ Orders Above Rs 500

10% off on Groceries (Upto Rs 100) on Blinkit app orders above Rs 499

FEES & LIST OF ALL CHARGES

Lifetime FREE Credit Card

Joining Fees: Nil

Annual Fees: Nil

ELIGIBILITY CRITERIA- CREDIT CARD

Required Age: 21-60 years

Employment status: Salaried or Self-Employed

Income: Rs 25,000 per month (Salaried and Self-employed)

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

DOCUMENTS NEEDED

Valid PAN Card

Aadhar Card – should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

IDFC FIRST Credit Card

Apply Now Click Here

Lifetime Free Credit Card

Rs 500 worth of gift voucher from IDFC Bank

Personal Accidental Cover Of Upto Rs 10,00,000

Upto 10X Rewards on Online Transactions

Upto 20% off on movie tickets every month

5% Cashback on First EMI Payment

ELIGIBILITY CRITERIA

Income group: Rs 25,000 and above

Age group: 18-70 years

Credit card holders are preferred

Required Age: 21-60 years

Documents Needed

PAN Card/Form 60

Address proof

Colour photograph

ID Proof

Income proof

Fees & List of all charges

Joining Fees: Nil

Annual Fees: Nil

Interest rate: 0.75-3.5% per month

Cash Withdrawal charges: Rs 250 per transaction

Card Replacement charges: Rs 100

IndusInd Legend Credit Card

Apply Now Click Here

Lifetime Free Credit Card | No Joining or Annual Fees

Earn 2 Reward Points on purchase of Rs 100 (1 Reward Point = Rs 0.75)

Buy 1 Get 1 Free on BookMyShow – 3 Free tickets every month

Instant Discount on Swiggy, EazyDinner & more brands

8 Complimentary Lounge Access (International & Domestic)

Get Priority pass membership

Lowest Forex Markup Charge in the market, 1.8%

Earn 4,000 bonus Reward Points on spending Rs 6,00,000 or more within one year from the date of issue of your credit card

PARTNER DISCOUNTS

Upto Rs 400 Off on Orders Above Rs 2000 on Ajio

Rs 100 Off on purchase of Food & Beverage on Orders Above Rs 350 on PVR

Additional 15% Off on Lifestyle on Orders Above Rs 1999

Get Upto Rs 1000 Off on Flight & Hotel bookings on EaseMyTrip

Get 15% discount (upto Rs 500) on Orders Above Rs 1500 on EazyDiner

ELIGIBILITY CRITERIA

Income group: Rs 80,000 for Salaried and Rs 1,00,000 for Self-Employed

Age group: 21-65 years

Credit Score: 650+

No Delayed Payments in the last 12 months

Existing Home or Auto Loan

Existing active credit card with a limit of more than Rs 50,000 of any bank

DOCUMENTS NEEDED

No physicals documents required

Keep your Aadhaar and PAN number handy

FEES & LIST OF ALL CHARGES

Lifetime Free Card

Joining Fees: Nil

Annual Fees: Nil

Annual Fee Waiver: Not applicable

Axis Neo Credit Card

Apply Now Click Here

Get 40% Off on Zomato – 2 times a month

10% Off on Myntra everytime

5% Off on Utility Bill payments via Amazon pay.- once per month

10% Off on Blinkit (Max Discount Rs 250)

10% Off on BookMyShow (Max discount – Rs 100) – valid once a month

OTHER AMAZING OFFERS

Get 1 Edge reward point on every Rs 200 spent ( 1 RP = Rs 0.20)

Upto 15% Off at partner restaurants under Dinning Delights program via EazyDiner

Get zero lost card liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

FEES & LIST OF CHARGES

Lifetime FREE Credit Card

Joining Fees: NA

Annual fees: NA

DOCUMENTS NEEDED

PAN Card/Form 60

Colour photograph

Address Proof

ID Proof

Bank statement or Income Proof

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 21,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-60 years

CREDIT CARDS WITH ANNUAL FEE & JOINING FEE APPLICABLE

SBI Cashback Credit Card – Welcome to the World of Amazing Cashback

Apply Now Click Here

5% Cashback on Online spends and 1% Cashback on Offline Spends

Cashback is capped at Rs 5000 per month combined for both Online & Offline spends

Annual fee waiver on annual spends of Rs 2,00,000 or more

MORE FEATURES OF THE CARD

1% Fuel Surcharge waiver upto Rs 100 / statement cycle on transaction between Rs 500 to Rs 3000

Add on Cards for your parents, spouse, children or siblings above the age of 18

Withdraw cash from over 1 million VISA across the globe

Card Cashback will be auto-credited to your SBI Card account within two days of your next statement generation

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 30,000 per month

Required Age: 21-60 years

Credit Score – 650+

New to credit – Only for Salaried

Credit Card holders are preferred

No delay payments in last 12 months

Card Holders should be an Indian Citizens or a Non Resident Indian

DOCUMENTS NEEDED

ID proof

Address proof

Income Proof

PAN Card/Form 60

FEES AND LIST OF CHARGES

Joining Fees: Rs 999 + GST

Annual Fees: Nil for First year, Rs 999 + GST – Second year onwards

Annual Fees will be waived on annual spends of Rs 2 Lacs

HDFC Shoppers Stop Credit Card

Apply Now Click Here

Complimentary First Citizen Silver Edge membership worth Rs 350

Earn 3x Reward points on Shoppers Stop Private brands shopping – 2.4% back

Welcome voucher worth Rs 500 redeemable on shopping of Rs 3000 or more at Shoppers Stop stores on private label brands

Bonus 2000 Reward points on annual spends of 2L or more

Link your Rupay Credit card with UPI and avail ~Scan n Pay~

OTHER AMAZING OFFERS

2.4% back as Reward Points on Shoppers Stop Private brands

0.8% back as Reward Points on other Shoppers Stop brands

0.8% back as Reward Points on all other spends like Groceries, shopping, etc

FEES AND LIST OF CHARGES

Joining Fees: Rs 299

Annual Fees: Rs 299

ELIGIBILITY CRITERIA

Age group: 21-65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 20,000 per month (Salaried)

Minimum Income: Rs 50,000 per month (Self-Employed)

Credit score: 700+

You should be citizen of India or a Non-Resident Indian

DOCUMENTS NEEDED

Address Proof – Aadhaar, Passport, Latest utility bills

ID proof – PAN, Voter ID, Passport

Income proof – Bank Statement, Salary Slips

Axis MyZone Credit Card

Apply Now Click Here

Get Complimentary SonyLiv Premium Annual Subscription of Rs 999

Flat Rs 120 Off on Swiggy on minimum order of Rs 500 applicable twice a month (Max discount Upto Rs 240 per month)

Buy one ticket and get 100% Off on second ticket at Paytm Movies (Max Discount Rs 200 per month)

All the Cashback that you earn using Axis My Zone Card, can be deducted from your credit card statement, just like real money

You Earn Flat Rs 1960 Profit on Successful Card Disbursal

OTHER FEATURES OF THE CARD

Upto Rs 1000 Off on AJIO on minimum spends of Rs 2999 on select styles

4 Complimentary Lounge access on select domestic airports (1 per quarter)

4 EDGE REWARDS points per Rs 200 spent (Not Applicable on fuel, movie, Insurance, Wallet, Rent, Utilities, Education, Government Institutions and EMI transactions)

Dining delights offering Upto 15% Off at partner restaurants in India (Max Discount Rs 500)

1% Fuel Surcharge waiver at all petrol pumps across the country for spends between Rs 400 to Rs 4000

FEES AND LIST OF ALL CHARGES

Joining Fees: Rs 500

Annual Fees: Rs 500

DOCUMENTS NEEDED

PAN Card/Form 60

Colour photograph

Address proof

ID Proof

Income proof

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-65 years

HSBC Cashback Credit Card – One of the best cashback credit cards in India!

Apply Now Click Here

Get 10% accelerated cashback on all dining, food delivery and grocery spends (capped upto Rs 1,000 per billing cycle)

4 complimentary domestic lounge visits per year (1 per quarter)

1.5% unlimited cashback on all other spends

Annual fee waiver on annual spends of Rs 2,00,000 or more

OTHER AMAZING OFFERS

Make transactions of minimum Rs 10,000 within first 30 days to get Amazon vouchers worth Rs 1000

5% discount on Amazon spendings of Rs 1,000 or above

Exclusive monthly offers on Amazon, Amazon pay, Blinkit, Easydinner, Pharmeasy etc.

Zero liability for lost cards

Emergency card replacement

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 4,00,000 per annum (for salaried individuals)

Required Age: 18-65 years

You must reside in any of the following cities: Bangalore, Chennai, Gurgaon, Hyderabad, Mumbai, New Delhi, Noida, Pune

DOCUMENTS NEEDED

PAN Card/Form 60

Address Proof

ID Proof

Income Proof

FEES & LIST OF CHARGES

Joining Fees: Rs 999 + GST

Annual Fees: Nil for First year, Rs 999 + GST Second year onwards

Annual Fees will be waived on annual spends of Rs 2 Lacs

SBI Simply Click Credit Card

Apply Now Click Here

Get Amazon Gift Card worth Rs 500 on payment of Annual Fee as a Welcome Gift from SBI Bank

Earn 10X Reward Points on online spends with exclusive partners like Apollo 24×7, BookMyShow, Cleartrip, Dominos, Eazydiner, Myntra, Netmeds & Yatra

Earn 5X Reward Points on all other online spends

OTHER AMAZING OFFERS

e-voucher worth Rs 2,000 on annual online spends of Rs 1 Lakh

e-voucher worth Rs 2,000 on annual online spends of Rs 2 Lakhs

1% fuel surcharge waiver for each transaction between Rs 500 & Rs 3000

Annual fee waiver on yearly spends above Rs 1 Lakh

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 30,000 per month and above

Required Age: 23-60 years

Credit Score – 650+

New to credit – Only for Salaried

Credit Card holders are preferred

No delay payments in last 12 months

Card Holders should be an Indian Citizens or a Non Resident Indian

DOCUMENTS NEEDED

ID proof

Address proof

Income proof

PAN Card/Form 60

FEES AND LIST OF ALL CHARGES

Joining Fees: Rs 499+GST

Annual Fees: Rs 499+GST Second year onwards

HDFC Bank IRCTC Credit Card

Apply Now Click Here

Get a Welcome voucher worth Rs 500 on card activation

5 Reward points for every Rs 100 spent on IRCTC ticketing website & Rail Connect App

Additional 5% Cashback on train ticket bookings via HDFC Bank SmartBuy

Credit Card to UPI – The HDFC IRCTC Credit Card can be linked to your UPI

OTHER AMAZING OFFERS

8 complimentary access to select IRCTC Executive Lounges every year (2 per quarter)

1% fuel surcharge waiver (Upto Rs 250) at all fuel stations across India (Transaction of Rs 400 – Rs 5,000)

Upto 50 days of interest free period on your IRCTC HDFC Bank Credit Card from the date of purchase

ELIGIBILITY CRITERIA

Age group: 21-60 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 25,000 per month (Salaried)

Minimum Income: Rs 6,00,000 per annum (Self-Employed)

DOCUMENTS NEEDED

Address Proof – Aadhaar, Passport, Latest utility bills

ID proof – PAN, Voter ID, Passport

Income proof – Bank Statement, Salary Slips

FEES & LIST OF ALL CHARGES

Joining Fees: Rs 500 + GST

Annual Fees: Rs 500 + GST

Axis Flipkart Credit Card

Apply Now Click Here

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-70 years

Standard Chartered EaseMyTrip Credit Card

Apply Now Click Here

Flat 10% instant discount on flight bookings at EaseMyTrip

10x rewards on every Rs 100 spent on Hotels & Flights

2 rewards on every Rs 100 spent on all other categories Value savings of more than Rs 27000 yearly on domestic trips

Complimentary lounge access – 1 domestic per calendar quarter and 2 international per year

ELIGIBILITY CRITERIA

Income group: Rs 7 Lacs and above yearly and above

Age group: 27-55 years

Documents Needed

1.PAN Card

2.Bank Statement for last 6 months

3.Aadhar Card

4.Payslip / ITR

Fees & List of all charges

Joining Fees: Rs 350 + GST

Annual Fees: Rs 350 + GST

Renewal fee (2nd year onwards) waived on spends of Rs 50,000 or more in the previous year

HDFC Bank Credit Card

Apply Now Click Here

Get Amazon Gift Voucher worth upto Rs 1500 as Welcome Gift

Exciting discounts on online purchases across partners brands

Complimentary access to airport lounges at domestic and international airports

Get lucrative vouchers on meeting minimum monthly spending criteria

Leverage revolving credit facilities at nominal interest rates

You earn rewards on all spends that can be redeemed for exciting gifts, vouchers or free flight tickets

ELIGIBILITY CRITERIA

Age group: 21-65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 20,000 per month (Salaried)

Minimum Income: Rs 50,000 per month (Self-Employed)

Credit Score: 700+

You should be citizen of India or a Non-Resident Indian

DOCUMENTS NEEDED

Address Proof – Aadhaar, Passport, Latest utility bills

ID proof – PAN, Voter ID, Passport

Income proof – Bank Statement, Salary Slips

FEES & LIST OF ALL CHARGES

Joining Fees: Starting at Rs 500 + GST (Depending upon the card selected)

Annual Fees: Starting at Rs 500 + GST (Depending upon the card selected)